Monday, December 13, 2010

Sunday, August 29, 2010

Information on Bangladesh Share Market: First Janata Bank Mutual FundIPO Lottery Result (2...

Information on Bangladesh Share Market: First Janata Bank Mutual FundIPO Lottery Result (2...: "First Janata Bank Mutual FundIPO Lottery Result (2010) Bank Code Branch Code Lotter..."

Information on Bangladesh Share Market: First Janata Bank Mutual FundIPO Lottery Result (2...

Information on Bangladesh Share Market: First Janata Bank Mutual FundIPO Lottery Result (2...: "First Janata Bank Mutual FundIPO Lottery Result (2010) Bank Code Branch Code Lotter..."

Tuesday, April 27, 2010

ICB 3rd NRB Mutual Fund IPO Result is available here

ICB 3rd NRB Mutual Fund IPO Result is available here

ICB 3rd NRB Mutual Fund IPO Result is available here

GENERAL

NRB

MUTUAL FUND

REFUND WARRANT

For more Please bookmark this blog.....

GENERAL

NRB

MUTUAL FUND

REFUND WARRANT

For more Please bookmark this blog.....

Thursday, April 22, 2010

Sunday, April 18, 2010

Tuesday, March 9, 2010

Monday, March 8, 2010

IPO result of IFIC 1st mutual Fund will be available here

The Scheule for IFIC Bank First Mutual Fund Lottery

Date & Time

March 09, 2010

(10:30 AM)

Venue

Bangabandhu International Conference Centre

Lottery Download link

1. Bank Code

2. General Public

3. NRB

4. Refund Warrant

Date & Time

March 09, 2010

(10:30 AM)

Venue

Bangabandhu International Conference Centre

Lottery Download link

1. Bank Code

2. General Public

3. NRB

4. Refund Warrant

Wednesday, March 3, 2010

Friday, February 19, 2010

Phonix 1st Mutual Fund prospectus is available

Phonix 1st Mutual Fund prospectus is available. Download it from following link.

Phoenix Finance 1st Mutual Fund

Phoenix Finance 1st Mutual Fund

R. A. K Ceramics Prospectus is available for download.

Please download R. A. K Ceramics Prospectus is available for download. Follow the Download Link.

R. A. K. Ceramics

R. A. K. Ceramics

Wednesday, February 17, 2010

R. A. K. Ceramics : IPO will be on Book Building : coming Soon

Important News-R.A.K. Ceramics BD Ltd.

R.A.K. Ceramics Bangladesh Ltd. has informed that it has decided to commence bidding from March 01, 2010 to March 03, 2010 by the eligible institutional investors (EII)(cont)cont-Important News-R.A.K.Ceramics BD

for price discovery of further issue of 34,510,000 ordinary shares through IPO under book building method.(end)Saturday, February 13, 2010

Phoenix Finance 1st Mutual Fund: Froms available here

Subscription Open: March 07, 2010

Subscription Close: March 11, 2010

For Non Resident Bangladeshi: March 07, 2010 to March 20, 2010

For Prospectus and Form always keep touch with this blog. Mutual Fund Review Download link is as

Phoenix Finance 1st Mutual Fund:

Subscription Close: March 11, 2010

For Non Resident Bangladeshi: March 07, 2010 to March 20, 2010

For Prospectus and Form always keep touch with this blog. Mutual Fund Review Download link is as

Phoenix Finance 1st Mutual Fund:

Saturday, January 30, 2010

Friday, January 29, 2010

Microsoft sees 60% jump in profit, boosted by Windows 7

Microsoft launched Windows 7 in October last year |

Microsoft has reported a 60% jump in profit, thanks largely to "exceptional demand" for Windows 7.

Net profit came in at $6.66bn (£4.13bn) for the three months to 31 December 2009, up from the $4.18bn it made in the same period a year earlier. It also reported record revenues of $19.2bn, which comfortably beat analysts' forecasts.

"We are thrilled by the consumer reception to Windows 7," said Kevin Turner, chief operating officer.

"This is a record quarter for Windows units."

Microsoft released Windows 7 in October last year.

'Outstanding'

Windows 7 has proved to be Microsoft's best-selling operating system to date after the disappointing Vista.

| Brendan Barnicle, Pacific Crest Securities |

The company's results are closely tied to computer sales because its two most profitable divisions make the Windows Operating System and Office business software.

"These are outstanding numbers," said Brendan Barnicle from Pacific Crest Securities.

"The upside was in the Windows business and service and tools, and Office business. The online business came in line and the only business shy of expectations was Xbox."

Shares in Microsoft rose 25 cents, or 0.9%, to $29.41 in after-hours trading.

Reporting season

The company did not make any specific profit or sales forecasts, after making the decision to stop doing so in January 2009, citing market volatility.

Microsoft is the latest technology company to report earnings results.

Yahoo and Apple both announced higher profits earlier this week, while Google reported strong figures last week.

However, Nintendo saw a near 10% fall in profits after a slowdown in sales of its Wii games console.

Source :BBC NEWS

Wednesday, January 27, 2010

Tuesday, January 26, 2010

Thursday, January 21, 2010

What is Price-Earning Ratio ?

A valuation ratio of a company's current share price compared to its per-share earnings.

Calculated as:

For example, if a company is currently trading at $43 a share and earnings over the last 12 months were $1.95 per share, the P/E ratio for the stock would be 22.05 ($43/$1.95).

EPS is usually from the last four quarters (trailing P/E), but sometimes it can be taken from the estimates of earnings expected in the next four quarters (projected or forward P/E). A third variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

Also sometimes known as "price multiple" or "earnings multiple".

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. However, the P/E ratio doesn't tell us the whole story by itself. It's usually more useful to compare the P/E ratios of one company to other companies in the same industry, to the market in general or against the company's own historical P/E. It would not be useful for investors using the P/E ratio as a basis for their investment to compare the P/E of a technology company (high P/E) to a utility company (low P/E) as each industry has much different growth prospects.

The P/E is sometimes referred to as the "multiple", because it shows how much investors are willing to pay per dollar of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay $20 for $1 of current earnings.

It is important that investors note an important problem that arises with the P/E measure, and to avoid basing a decision on this measure alone. The denominator (earnings) is based on an accounting measure of earnings that is susceptible to forms of manipulation, making the quality of the P/E only as good as the quality of the underlying earnings number.

Calculated as:

For example, if a company is currently trading at $43 a share and earnings over the last 12 months were $1.95 per share, the P/E ratio for the stock would be 22.05 ($43/$1.95).

EPS is usually from the last four quarters (trailing P/E), but sometimes it can be taken from the estimates of earnings expected in the next four quarters (projected or forward P/E). A third variation uses the sum of the last two actual quarters and the estimates of the next two quarters.

Also sometimes known as "price multiple" or "earnings multiple".

In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. However, the P/E ratio doesn't tell us the whole story by itself. It's usually more useful to compare the P/E ratios of one company to other companies in the same industry, to the market in general or against the company's own historical P/E. It would not be useful for investors using the P/E ratio as a basis for their investment to compare the P/E of a technology company (high P/E) to a utility company (low P/E) as each industry has much different growth prospects.

The P/E is sometimes referred to as the "multiple", because it shows how much investors are willing to pay per dollar of earnings. If a company were currently trading at a multiple (P/E) of 20, the interpretation is that an investor is willing to pay $20 for $1 of current earnings.

It is important that investors note an important problem that arises with the P/E measure, and to avoid basing a decision on this measure alone. The denominator (earnings) is based on an accounting measure of earnings that is susceptible to forms of manipulation, making the quality of the P/E only as good as the quality of the underlying earnings number.

What is Earning Per Share (EPS) ?

The portion of a company's profit allocated to each outstanding share of common stock. Earnings per share serves as an indicator of a company's profitability.

Calculated as:

When calculating, it is more accurate to use a weighted average number of shares outstanding over the reporting term, because the number of shares outstanding can change over time. However, data sources sometimes simplify the calculation by using the number of shares outstanding at the end of the period.

Diluted EPS expands on basic EPS by including the shares of convertibles or warrants outstanding in the outstanding shares number.

Earnings per share is generally considered to be the single most important variable in determining a share's price. It is also a major component used to calculate the price-to-earnings valuation ratio.

For example, assume that a company has a net income of $25 million. If the company pays out $1 million in preferred dividends and has 10 million shares for half of the year and 15 million shares for the other half, the EPS would be $1.92 (24/12.5). First, the $1 million is deducted from the net income to get $24 million, then a weighted average is taken to find the number of shares outstanding (0.5 x 10M+ 0.5 x 15M = 12.5M).

An important aspect of EPS that's often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS number, but one could do so with less equity (investment) - that company would be more efficient at using its capital to generate income and, all other things being equal, would be a "better" company. Investors also need to be aware of earnings manipulation that will affect the quality of the earnings number. It is important not to rely on any one financial measure, but to use it in conjunction with statement analysis and other measures.

Calculated as:

When calculating, it is more accurate to use a weighted average number of shares outstanding over the reporting term, because the number of shares outstanding can change over time. However, data sources sometimes simplify the calculation by using the number of shares outstanding at the end of the period.

Diluted EPS expands on basic EPS by including the shares of convertibles or warrants outstanding in the outstanding shares number.

Earnings per share is generally considered to be the single most important variable in determining a share's price. It is also a major component used to calculate the price-to-earnings valuation ratio.

For example, assume that a company has a net income of $25 million. If the company pays out $1 million in preferred dividends and has 10 million shares for half of the year and 15 million shares for the other half, the EPS would be $1.92 (24/12.5). First, the $1 million is deducted from the net income to get $24 million, then a weighted average is taken to find the number of shares outstanding (0.5 x 10M+ 0.5 x 15M = 12.5M).

An important aspect of EPS that's often ignored is the capital that is required to generate the earnings (net income) in the calculation. Two companies could generate the same EPS number, but one could do so with less equity (investment) - that company would be more efficient at using its capital to generate income and, all other things being equal, would be a "better" company. Investors also need to be aware of earnings manipulation that will affect the quality of the earnings number. It is important not to rely on any one financial measure, but to use it in conjunction with statement analysis and other measures.

Wednesday, January 20, 2010

Tuesday, January 19, 2010

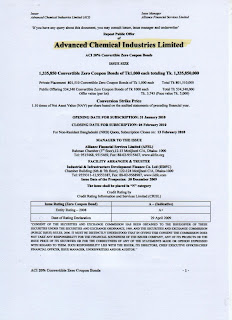

ACI DECLARES 20% CONVERTIABLE ZERO COUPON BONDS

In another word A zero-coupon bond (also called a discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond. Investors earn return from the compounded interest all paid at maturity plus the difference between the discounted price of the bond and its par (or redemption) value. Examples of zero-coupon bonds include U.S. Treasury bills, U.S. savings bonds, long-term zero-coupon bonds, and any type of coupon bond that has been stripped of its coupons.

In contrast, an investor who has a regular bond receives income from coupon payments, which are usually made semi-annually. The investor also receives the principal or face value of the investment when the bond matures.

Some zero coupon bonds are inflation indexed, so the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power rather than a set amount of money, but the majority of zero coupon bonds pay a set amount of money known as the face value of the bond.

Zero coupon bonds may be long or short term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Prospectus of ACI ZERO COUPON BONDS

In contrast, an investor who has a regular bond receives income from coupon payments, which are usually made semi-annually. The investor also receives the principal or face value of the investment when the bond matures.

Some zero coupon bonds are inflation indexed, so the amount of money that will be paid to the bond holder is calculated to have a set amount of purchasing power rather than a set amount of money, but the majority of zero coupon bonds pay a set amount of money known as the face value of the bond.

Zero coupon bonds may be long or short term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Prospectus of ACI ZERO COUPON BONDS

Monday, January 18, 2010

APPLICATION FORM IS AVAILABLE : IFIC Bank declares 1st mutual fund of 120 crore

IFIC Bank declares 1st mutual fund of 120 crore. Following are schedule of that IPO

The Scheule for receiving Initial Public offering(IPO) Units Application forms

For Resident Bangladeshi

February 7, 2010 to February 11,2010 (09:00 AM to 04:00 PM)

Bankers to the issue as mentioned in application From

For Non-Resident Bangladeshi's subscription closes on February 20,2010 (By Post office/Courier service only). Subscription sent by Post/Courier will be received in the Company's Head office only.

Following are link for downloading Forms and prospectus

IFIC BANK 1st MUTUAL FUND

The Scheule for receiving Initial Public offering(IPO) Units Application forms

For Resident Bangladeshi

February 7, 2010 to February 11,2010 (09:00 AM to 04:00 PM)

Bankers to the issue as mentioned in application From

For Non-Resident Bangladeshi's subscription closes on February 20,2010 (By Post office/Courier service only). Subscription sent by Post/Courier will be received in the Company's Head office only.

Following are link for downloading Forms and prospectus

IFIC BANK 1st MUTUAL FUND

Thursday, January 14, 2010

DBH 1st Mutual fund IPO Lottery Result : Download it

Following are Download link of DBH 1st Mutual fund

IPO Lottery Result :

all above in a Download Link is :

Tuesday, January 12, 2010

Thursday, January 7, 2010

ACI declare zeo coupon convertible Bonds for Bangladesh Share Market

Zero Coupon bonds

In finance, a convertible note (or, if it has a maturity of greater than 10 years, a convertible debenture) is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. It is a hybrid security with debt- and equity-like features. Although it typically has a low coupon rate, the instrument carries additional value through the option to convert the bond to stock, and thereby participate in further growth in the company's equity value. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments.

From the issuer's perspective, the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. However, in exchange for the benefit of reduced interest payments, the value of shareholder's equity is reduced due to the stock dilution expected when bondholders convert their bonds into new shares.

a zero-coupon bond issued by a corporation which can be converted into that corporation's common stock at a certain price, or a zero-coupon bond issued by a municipality which can be converted into an interest-bearing bond under certain circumstances. also called split coupon bond. [For more on Covertible Bonds Please visit http://en.wikipedia.org/wiki/Convertible_bond ]

In Bangladesh, for the first time ACI declare zero coupon convertible bonds for local Stock Market. It's RPO will start on 31st January , 2010.

Details has been given in scanned images.

Monday, January 4, 2010

Dhaka Insurance IPO Application Status : DOWNLOAD Result

Dhaka Insurance Limited (Subscription Open: 06.12.09, Close: 10.12.09 )

Nature of Business Insurance

Subscription Open December 06, 2009

Subscription Open December 06, 2009

Subscription Close December 10, 2009

For Non resident Bangladeshi December 06, 2009 to December 19, 2009

Offer Price (Tk.) 120.00

Face Value (Tk.) 100.00

Market lot (Share) 50

Sponsors Portion (Share) 600,000

Public Offer (Share) 900,000

Total Issued Shares 1,500,000

Total Paid up Capital (after IPO) Tk. 150,000,000.00

Face Value (Tk.) 100.00

Market lot (Share) 50

Sponsors Portion (Share) 600,000

Public Offer (Share) 900,000

Total Issued Shares 1,500,000

Total Paid up Capital (after IPO) Tk. 150,000,000.00

EPS (as per prospectus) 33.87 (as on 31.12. 2008)

NAV per share (as per prospectus) 187.94 (as on 31.12 . 2008)

NAV per share (as per prospectus) 187.94 (as on 31.12 . 2008)

Website www.dhakainsurance.com

The Present IPO STATUS of Dhaka Insurance is as follows :-

the primary status of the IPO of Dhaka Insurance Ltd. is: Total amount of subscription (excluding NRB) =Tk.5,369,928,000 & Total No. of application=785,256. Total amount received from NRB =Tk. 151,764,000 & Total application from NRB=25,249.

ALL RESULT WILL BE DOWNLOADED FROM HERE

1. GENERAL

2. NRB

3. BANK AND BRANCH CODE

4. REFUND WARRANT SCHEDULE

CLICK LINK FOR ALL DHAKA INSURANCE IPO RESULT DOWNLOADING..........

ALL RESULT WILL BE DOWNLOADED FROM HERE

ALL RESULT WILL BE DOWNLOADED FROM HERE

1. GENERAL

2. NRB

3. BANK AND BRANCH CODE

4. REFUND WARRANT SCHEDULE

CLICK LINK FOR ALL DHAKA INSURANCE IPO RESULT DOWNLOADING..........

ALL RESULT WILL BE DOWNLOADED FROM HERE

Sunday, January 3, 2010

Trust Bank 1st Mutual Fund : IPO LOTTERY RESULT

IPO LOTTERY DOWNLOAD LINK

As Per SEC declaration :All concerned are hereby informed that the IPO lottery program of Trust Bank First Mutual Fund will be conducted on 3 January 2010 at 10:30 am at Harmony Hall, Banladesh-China Friendship Conference Center, Sher-E-Bangla Nagor, Agargaon,Dhaka.

~~~~

Trust Bank Limited Mutual Fund : IPO Lottery result has been published. I got complete lottery sheets in pdf files. For sharing with friend of Bangladesh, I have uploaded this too in rapidshare and giving the links to my friends.

Download it from following links. you may also get regular IPO information from my blog site. In my blog zone "Share Your Ideas" You may get regular updates on other financial news from Bangladesh and regular important news from all over the world.

Download Link is as;

http://rapidshare.com/files/329604765/Trust_Bank_Mutual_fund.rar.html

Subscribe to:

Posts (Atom)

IMPORTANT NEWS FOR RECENT IPO IN BANGLADESH SHARE MARKET

Presently Available IPO Form of Emerald Oil, Matin Spinnings

For support please mail me or post a comment here in related topics.